If you are a business owner, you know that managing finances can be overwhelming. One of the most significant expenses for most companies is leasing. Keeping track of leases and complying with the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) guidelines can be challenging without the right tools. That's where lease accounting software comes in. In this article, we will explore what lease accounting software is, its benefits, features, and how to choose the right one for your business.

What is Lease Accounting Software?

Lease accounting software is a tool that helps businesses manage their lease obligations. It automates lease data collection, helps businesses comply with accounting standards, and makes lease management more efficient. The software can track lease payments, terms, and options to renew or terminate leases. It also generates lease accounting reports for compliance purposes.

Benefits of Using Lease Accounting Software

Compliance with accounting standards: Lease accounting software helps businesses comply with FASB and IASB accounting standards by automating the lease data collection process.

Increased efficiency: With lease accounting software, businesses can streamline the lease management process, reducing manual data entry, and errors.

Better decision-making: The software provides accurate data and reports that can help businesses make informed decisions about leasing.

Cost savings: By tracking lease payments and terms, businesses can avoid costly penalties and ensure that they are not overpaying for leases.

Features of Lease Accounting Software

Lease data collection: The software can collect data from lease contracts, including payment terms, lease start and end dates, and renewal options.

Lease accounting: The software calculates the present value of lease payments and generates accounting reports, including balance sheets, income statements, and cash flow statements.

Lease management: The software can track lease options, such as renewal and termination, and provide alerts when leases are due for renewal or termination.

Integration: The software can integrate with other financial systems, such as general ledgers and accounts payable, to streamline the lease accounting process.

How to Choose the Right Lease Accounting Software for Your Business

Compliance: Ensure that the software is compliant with FASB and IASB accounting standards.

Features: Choose a software with the features that meet your business needs, such as lease data collection, lease accounting, lease management, and integration.

User-friendly: Choose a software that is easy to use, with an intuitive interface and clear instructions.

Scalability: Choose a software that can scale with your business needs, from small to large businesses.

Customer support: Choose a software with excellent customer support, including training, implementation, and ongoing technical support.

Lease accounting software pricing:

Lease accounting software pricing can vary depending on the features and the size of the business. Some lease accounting software providers offer a subscription-based pricing model, where businesses pay a monthly or annual fee for access to the software. Others offer a one-time purchase option, where businesses pay a lump sum for the software.

Subscription-based pricing can range from $50 to $500 per month, depending on the features and the number of leases managed. The price typically increases as the number of leases and users increases. Some providers offer different pricing tiers based on the number of leases managed or the size of the business.

One-time purchase pricing can range from $500 to $5,000 or more, depending on the software's features and the number of licenses required. Some providers offer a discount for businesses that purchase multiple licenses.

In addition to the base price, businesses may also need to pay for implementation and training services. Implementation fees can range from $1,000 to $10,000 or more, depending on the complexity of the business's lease portfolio and the software's features. Training fees can range from $500 to $2,000 or more, depending on the number of users and the level of training required.

It is important to note that some lease accounting software providers may charge additional fees for support services or software updates. Businesses should carefully review the pricing and the terms and conditions before selecting a lease accounting software provider.

Best 10 lease accounting software for small business :

Lease accounting software can help small businesses efficiently manage their lease portfolios, comply with lease accounting standards, and make informed business decisions.

Here are 10 lease accounting software options that are well-suited for small businesses:

LeaseQuery: LeaseQuery offers a user-friendly interface, automated lease classification, and reporting tools. The software also offers lease abstracting and integration with popular accounting software.

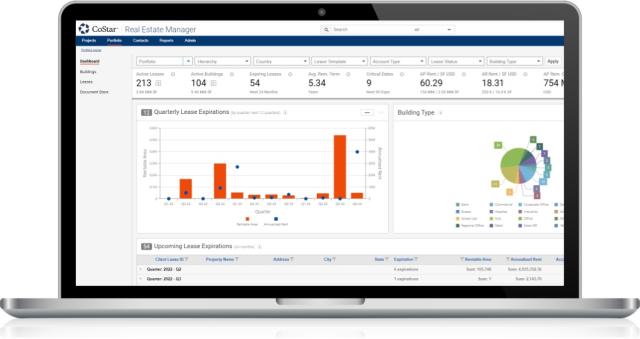

CoStar Real Estate Manager: CoStar Real Estate Manager offers lease management, accounting, and reporting tools. The software also offers a centralized database for all lease-related information.

LeaseAccelerator: LeaseAccelerator offers lease accounting and management tools, as well as a lease marketplace where businesses can find lease financing options.

Visual Lease: Visual Lease offers a cloud-based lease management and accounting platform with automated lease classification, lease abstracting, and reporting tools.

ProLease: ProLease offers lease management and accounting tools, as well as real estate portfolio management and space management capabilities.

EZLease: EZLease offers lease management and accounting tools, as well as real estate portfolio management and project management capabilities.

Nakisa Lease Administration: Nakisa Lease Administration offers lease management, accounting, and reporting tools, as well as integration with popular accounting software.

FMX: FMX offers lease management and accounting tools, as well as real estate portfolio management and facilities management capabilities.

PowerPlan: PowerPlan offers lease accounting and management tools, as well as asset management and project management capabilities.

LeaseCrunch: LeaseCrunch offers lease accounting and management tools, as well as integration with popular accounting software and reporting tools.

Small businesses should carefully evaluate the features and pricing of each lease accounting software option before making a selection. It is also important to consider the business's specific lease management needs and accounting requirements.

Conclusion

Lease accounting software is a valuable tool for businesses that need to manage lease obligations efficiently and comply with accounting standards. With the right software, businesses can streamline the lease management process, increase efficiency, and make better decisions. When choosing a lease accounting software, consider compliance, features, user-friendliness, scalability, and customer support.

FAQs

Is lease accounting software mandatory for businesses?

No, it is not mandatory, but it is highly recommended for businesses that lease assets.

How does lease accounting software help businesses save money?

By tracking lease payments and terms, businesses can avoid costly penalties and ensure that they are not overpaying for leases.

Can lease accounting software integrate with other financial systems?

Yes, most lease accounting software can integrate with other financial systems, such as general ledgers and accounts payable.